Private Credit...this time is different

Or is it?

As equities continue their climb to new highs driven from the ever bullish money flows and also from the narrative that AI is going to permanently alter the course of labor markets and the future as we know it, I can’t help but wonder while Mr. Market keeps looking in this direction if there is something else happening behind his back?

That something I believe is the rapid rise in private credit (PC) that is now starting to show signs of some cracking. This writing isn’t to signal that tomorrow the dam breaks but to provide some commentary on what I see and highlight the risks in a frothy market.

Post 2008, as Wall & Main Street looked like Apollo Creed and Rocky Balboa after the 15th round, regulations were put into place to “ensure” a situation like the global financial crisis (GFC) would not happen again. The Dodd-Frank Act was passed and excessive leverage use and lending was to never to happen again and everyone learned their lesson…..or so many hoped coming out of the great recession.

Size Of The Market:

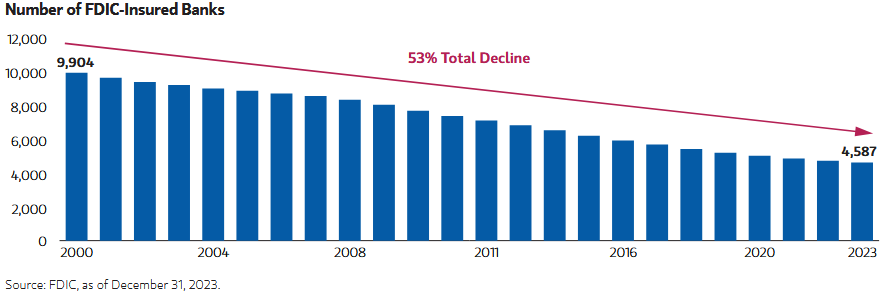

Morgan Stanley, PitchBook, Moody’s, and others estimate that private credit has grown to a $1.6-$1.8 trillion business by the end of 2024 and by 2028 it is projected to be at $2.3T. How has this market boomed so much? Well, U.S. bank counts have shrunk by 53% since 2000-2023 according to FDIC data and with fewer banks and tighter regulations this has created less desire to lend. In steps private credit.

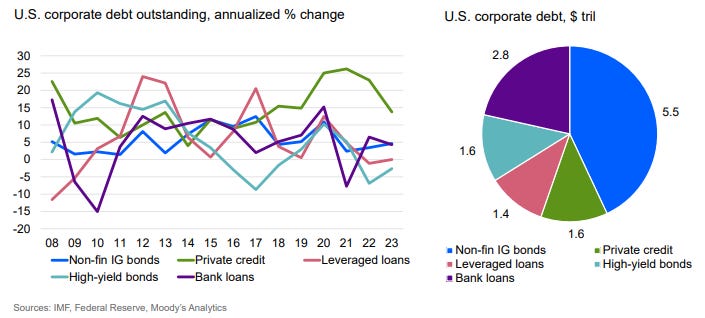

If we look at the graph below, we can see data collected from the IMF, Federal Reserve, and Moody’s has private credit estimated at $1.6T which is about 12% of the entire corporate debt market, but the important takeaway is that while it is 12% today it is the fastest growing segment:

Post Inflation Boom:

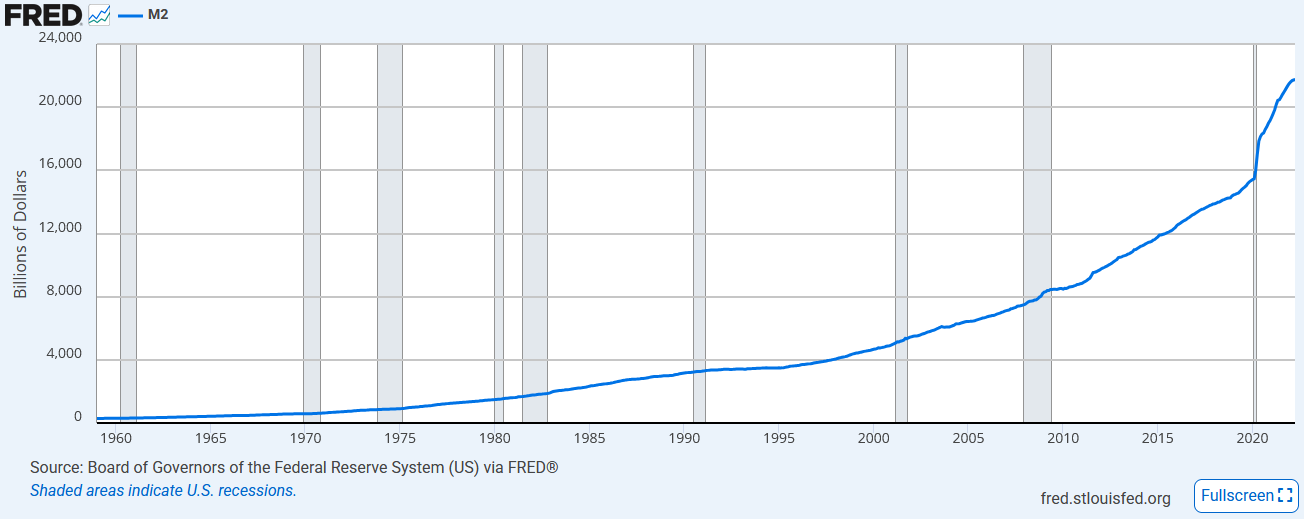

While private credit saw a boom post 2008 it was the events post-2022 that really gave it the steroid boost it needed. While markets cratered in March of 2020 due to the Covid-19 events, the Federal Reserve stepped to the plate and dropped the effective federal funds rate (EFFR) to 0.08% and with Congress approval began the largest Quantitative Easing (QE) campaign the U.S. had seen. While the world was shutdown due to Covid, easy money flowed into the system keeping demand flush while supply was completely non-existent. As quarantine orders began to relax the already hot demand pull went into overdrive. Suppliers did everything they could to resolve supply constraints and the result was some of the highest inflation the U.S. had seen since the 1970’s. As inflation began to be labeled as transitory the Federal Reserve continued with ZIRP and QE until it became clear inflation was indeed not transitory. If one takes the quantity theory of money into consideration, tracking the growth of the money supply was a good indicator of where inflation was going:

This eventually led to a tightening campaign that saw to one of the deepest bond bear markets in recent history (last event would have been during the 1994 bond massacre but that only lasted until 1995) and a bear market in equities in 2022; bond bears are still winning in 2025 while equities have reached multiple new highs.

This tightening cycle and movements in bonds led to a regional banking crisis by March 2023. A few regional banks, like Silicon Valley Bank, failed and the Fed stepped in with new programs like the Bank Term Funding Program (BTFP) to provide immediate liquidity. While all of this was going on it allowed the private credit markets to step in for the banks and provide the lending. There are of course details from the 2023 events that deserve their own coverage but for another time maybe.

This all leads us to where we are today. Private credit, like most bubbles before it, act like a star with controlled by hydrostatic equilibrium. They generate their energy for many years (stars for millions) but gravity keeps them contained and in check, but once the core goes out this equilibrium becomes unbalanced and they begin to rapidly expand in simple terms. Private credit has been a star that provided liquidity and growth within the economy for over a decade, but I believe now that equilibrium is starting to crack and even though our star is expanding it will likely end the same as every other - in collapse; except a star can’t get a bailout from the Federal Reserve which private credit is likely to get. Once upon a time the fed was not buying MBS and now the housing market would likely not function the way it does if they were not holding MBS on their balance sheet. Once upon a time the fed didn’t need to buy $40B monthly for “plumbing” support and the treasury market would not function the way it does if they were not. LTCM, while no direct funding from the fed had their hands all over it. Each new financial event requires more support and each new support creates an even bigger financial event.

What is private credit?

What exactly is private credit? It’s nothing more than debt instruments that are not issued or traded in the public markets. Traditional public lending methods would be one an investor sees when a company issues say corporate bonds. For example, if a public company is filing to issue debt to raise capital and they do this via the traditional public debt markets you would see an SEC 8-K filed with the bond prospectus that gives you all the wonderful details about the bond and usually have a bank involved. This is not the case for a private credit offering. Borrowers may not have to present any financial details publicly and any reporting can vary from capital raising to capital raising and company to company. Private credit also does not have to play by the same reporting and transparency standards as public credit does. To be clear public debt raising does not have to be done by a public company, but I highlight the above as a way to demonstrate the transparency that does exist. During the early runs most of the private credit lending was done in the middle markets (private sector companies not necessarily traded publicly), but as private credit has expanded many large public companies are turning here too.

Some of the biggest players in the private credit game are Apollo, Ares, Atlas Credit Partners, Blue Owl, KKR, Oaktree, BlackRock, and Blackstone.

Now for lenders a downside risk to lending via private credit is the market is not as liquid as it is for public debt. For example, if a company issues public debt in a primary offering you will often later eventually see them sold on a secondary market as the original buyer may want to move out of their position and not hold until maturity. Because private debt is not traded on a public market, getting them into secondary hands can be challenging. This risk appears to have been offset by the fact that private credit often offers a higher yield over what would be found in the public markets.

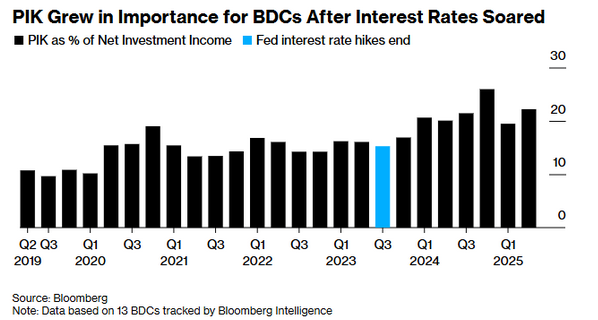

When we look at that higher yield though a portion of this is driven by current tight monetary policy. July 2025 the Federal Reserve released a paper titled “Indirect Credit Supply: How Bank Lending to Private Credit Shapes Monetary Policy Transmission”. What they found is banks lending to nonbank lenders is impacted by monetary policy as borrowing costs do go up. The paper states “in other words, while the extension of the credit chain mitigates the contraction in credit supply, it also amplifies the price channel of monetary policy.” and also “higher borrowing costs mean that monetary policy still transmits effectively through the price channel. As nonbank lending continues to expand, these results provide important insight on how future policy changes might propagate through increasingly complex intermediation chains.”. While the cost of borrowing has gone up this is where this benefit has partially come from. Organizations will often take on whatever they can to keep the operation moving, so paying a higher interest rate is not necessarily going to stop them, it is up to the lenders to do that which is often where would see risk management for the banks kick in. Somewhat proof of this is in the rise of PIK use which I will cover below.

Another thought for readers is monetary policy often moves with a lag. In developed economies this lag can be 18-24 months which means every time we see a rate hike or cut there is a lagged effect until that trickles into the economy.

This is partly why I believe the Federal Reserve is starting to move as they are with lowering rates more aggressively and even starting their “reserve management purchases” which will see $40B of T-Bills bought per month. PwC estimates there is $3.2T of corporate debt maturing in the next two years and at these higher rates the cost of borrowing is likely too high to sustain for these middle market organizations and even harder if we do indeed see a recession form. PitchBook notes that private credit is about 17% of all this debt that is set to mature in two years.

Why Would A Business Use Private Credit Over Traditional Lending?

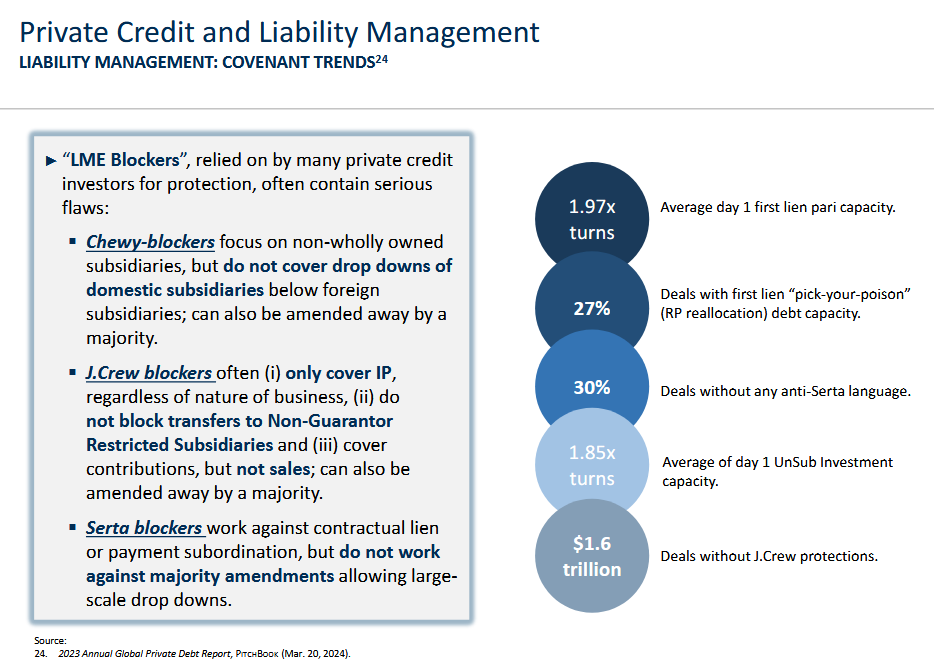

A question you may be asking is why would a company take on private credit vs. going the traditional route and having a bank help them issue corporate bonds to raise capital? The answer is again because banks themselves have tighter lending standards than in years past which give them stricter capital requirements and risk management protocols - it’s very likely many of the companies trying to raise capital today cannot get it via the traditional methods. And as liability management exercises (LME) begin to grow in use this itself will make traditional methods harder to access as covenants will start to become tighter to prevent the recent rise of drop-down, uptiers, and every other creative way creditor-on-creditor violence has recently become the norm.

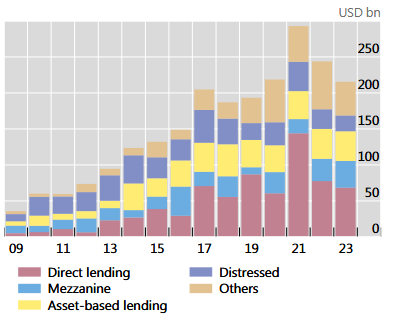

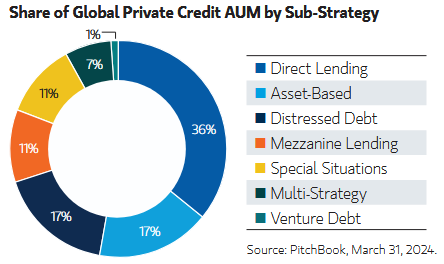

Public debt offerings often came with restrictive loan structures that private credit was willing to do differently to secure the deal. Some of these different things would be maybe longer repayment schedules, looser covenants, payment-in-kind (PIK), and their willingness to underwrite for unconventional deals public credit wouldn’t touch. Private credit is often more willing to structure loans in multiple ways depending on the lenders needs. This can range from direct lending, distressed debt lending, or debt/equity lending. To get a feel for the breakdown below is some data from BIS that shows the types of private lending from 2009-2023:

PitchBook also breaks the data down a bit differently:

Direct lending though is by far the biggest category in the private credit bucket and continues to grow YoY. In fact so far this year we see direct lending with the highest volume since 2022 BUT also on lower counts meaning that less loans are being generated but for higher value concentrating the risk.

An example of this is the company Shutterfly Inc. which has $2.5B of gross debt and $2.4B of net debt and 84% of that debt is set to mature between 2026-2027. While access to debt via traditional methods was likely not an option (given prior Shutterfly troubles and use of LME tactics) they turned to General Atlantic who was willing to put up $2B of private credit. S&P expects Shutterfly to generate $353M of EBITDA in 2025. Bally’s Corp raised $1.1B from Ares Management Credit, King Street Capital Management, and TPG Credit as their attempt to amend a term-loan with Deutsche Bank AG went south.

Another reason you may see a borrower want to take on private credit is ratings agencies are not really a factor here. For example, a company may raise debt that at the time was investment grade and thus was affordable for the company. As time goes on their financial performance deteriorates and the ratings agencies downgrade the company (if the company goes from investment grade to junk they would be known as a fallen angel). This ratings downgrade would then make it challenging for the company to raise new public debt because it can make the new costs higher, see tighter covenants, higher seniority, shorter duration, and various other things that make it risky for a lender who will want to protect themselves. In the private credit space the credit rating is often not a factor in the lending process making this much more attractive for a borrower to try.

All of this leads to another wonderful thing - speed. While going through the traditional process is faster than it used to be, the lack of regulation and other factors makes accessing private credit much faster. Instead of weeks to raise capital you can likely do this in days via private credit. Many of the borrowers have relationships with PC firms and that also helps move the process quicker.

Moody’s also gives some research on the reasons why U.S. borrowers are selecting private credit over traditional lending paths:

When one door closes though another one opens and this door is happily opened by Wall Street.

First Domino - First Brands:

The first major sign of stress in the private credit markets comes with a current famous case: First Brands.

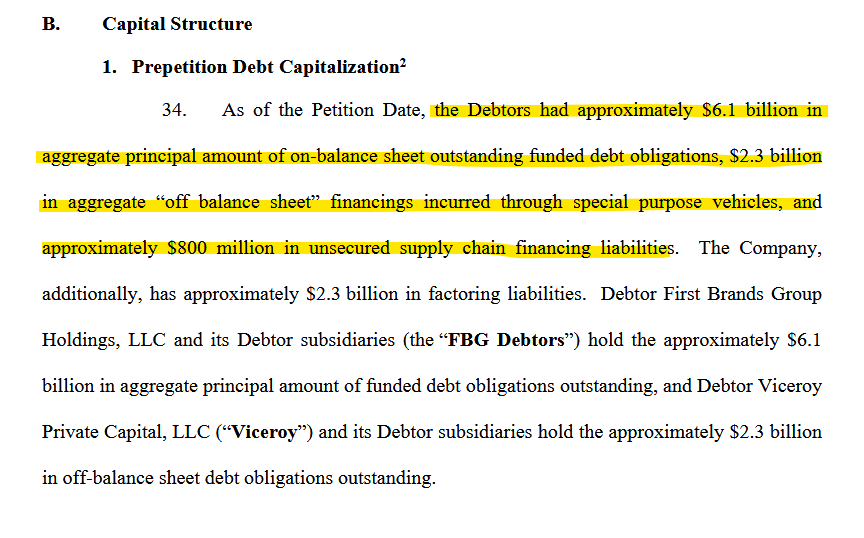

While this is not a post about First Brands specifically, I will cover some of the details for context. The company filed Chapter 11 bankruptcy in September of 2025 and at the time of filing had 26,000 employees with 6,000 being in the U.S.. The company had $6.1B of debt on the balance sheet and $2.3B in off-balance sheet that was raised via Special Purpose Vehicle (SPV) methods as well as another $800M in unsecured supply chain financing and $2.3B in factoring liabilities. Below is a snip from the First Brands Chapter 11 filing document:

What is most interesting about First Brands is the mix between traditional lending and private lending methods. The use of special purpose vehicles (SPV) or also known as a special purpose entity (SPE) allowed the company to tap into the private lending markets and allowed them to distort things like their EBITDA margin and growth potential which clouded the ratings agencies. December 2023 S&P revised the outlook for First Brand to positive on growth and their sustaining better margins and they affirmed their B+ rating. S&P in their December 2023 rating stated:

“First Brands expects to generate nearly $4 billion of revenues in 2023, up more than 40% from the previous year and 2.5 times bigger than its 2020 revenue base. First Brands grew revenue primarily by acquiring underperforming brands and launching new products, which has enabled the company to grow share with customers, particularly large, big box auto parts retailers. The company’s increased scale has contributed to improved operating leverage and efficiency at its plants as well as greater purchasing power with its vendors.

Furthermore, the company has realized cost savings related to prior-period restructuring actions including headcount reductions, plant consolidation, and changes to its procurement processes. These actions along with increased operating leverage have resulted in EBITDA margins of around 25% through the first three quarters of 2023, above our previous estimate and in line with the previous year. While we do not expect the company to maintain margins at 25%, we forecast the company to maintain margins of at least 20%, somewhat weaker than this year because the less profitable acquired businesses burden margins.”

In March 2024 Fitch was a bit more pessimistic downgrading First Brands from BB- to B+ but still well above where they should have been. Given how the situation unfolded a bit over a year later, both ratings agencies should have had this well into junk bond territory, but instead had them towards the top of highly speculative. First Brands use of private credit and SPV’s allowed them to fool even those in the traditional lending arena.

As part of the Chapter 11 filing First Brands received a debtor-in-possession (DIP) funding of $1.1B. For a quick summary, in Chapter 11 DIP financing can be provided when approved by a judge which gives those lenders the ability to inject new capital but to do so that capital then becomes priority above the prepetition (before bankruptcy) debt. What is then interesting is we see this $1.1B DIP loan already trading at $0.63 on the $1.00. Marathon Asset Management and Redwood Capital Management are among the funds who provided the DIP and are already cashing portions of this out. As Bloomberg reported on December 9th, 2025:

“Price levels from trading desks this week reflected investor fears. First Brands’ $1.1 billion debtor-in-possession loan — the first in line to be repaid — was quoted at as little as 63 cents on the dollar, down from 100 cents just a week ago. Its other debt is deemed virtually worthless.”

First Brands was later followed by Tricolor which Jamie Dimon from JPMorgan stated was “not our finest moment.”. What one should start to take away is the private lending and public lending are not as separated as one may think. In fact this notion that banks are not exposed could be challenged by the above.

Are Banks Shielded From Private Credit Lending?

It’s also worth noting that as I shared above the banks are already lending into these private credit markets so their exposure is not non-existent. November 18th, 2025 the Federal Reserve Bank of New York wrote an article titled “U.S. Banks Have Developed a Significant Nonbank Footprint” where Nicola Cetorelli ended the article with “In other words, the modern U.S. banking firm is not the textbook institution defined by its deposit taking and loan making operations. Left to themselves, in a relatively unconstrained environment, banking firms will naturally expand their boundaries to include any relevant type of specialized institution engaging in financial intermediation.

But why have so many banks pursued a strategy of business scope expansion, and by including many NBFI subsidiaries under their organizational umbrellas? We delve deeper into this important question in the next post.”.

The reason for this expansion is simple: private credit is expanding rapidly and banks are losing revenue potential. While private credit was able to take advantage and lend freely the banks were restricted and missed out and are set to continue to miss out. As I mentioned above, PwC estimates there is $3.2T of corporate debt that is maturing in two years and needs to be financed and if the banks miss out here there is $70B in annualized revenue that likely goes to private credit:

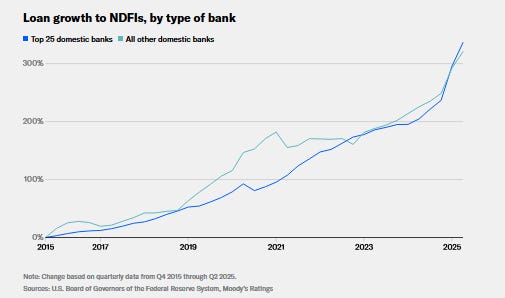

The banks are now in a position to chase the same risky assets as private credit to ensure they get their piece of the pie. Thus, I challenge the notion that public lending and private lending are not as separated and there is risk to the banking sector in the event the assets in the private credit pools begin to turn.

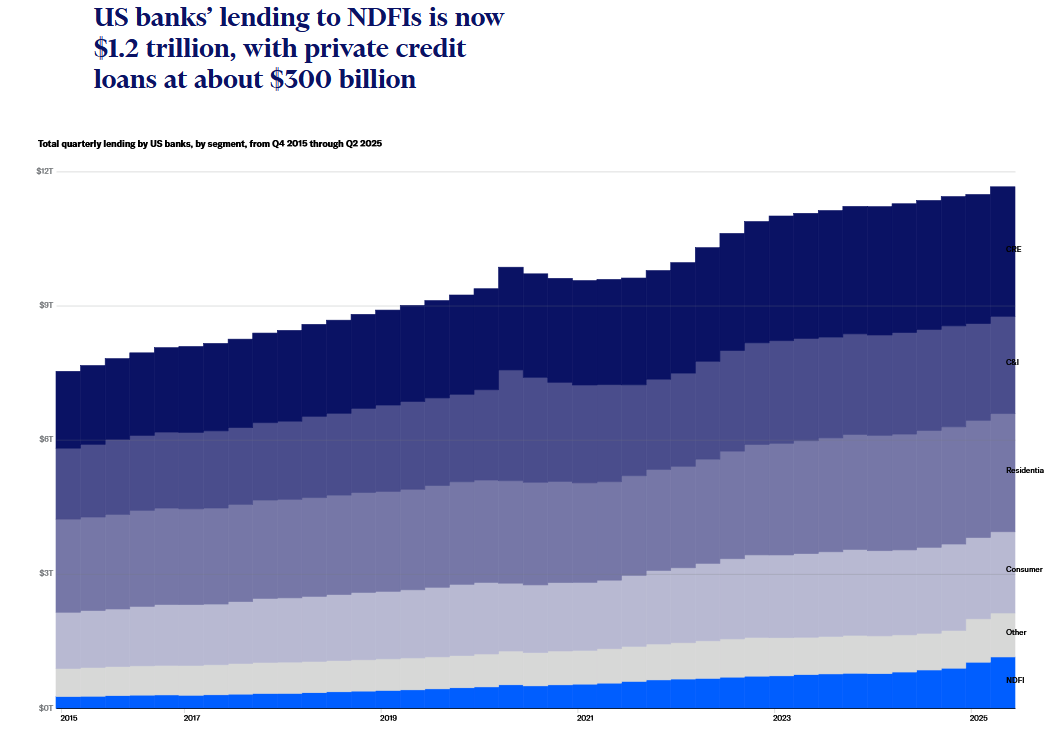

If we look at the banks for example, Moody’s estimates that lending to non-depository institutions to be $1.2T with loans for private credit at $300B:

Loans to NDFI’s are the fastest growing category for U.S. banks as they are 10.4% of total bank loans which almost 3x the 3.6% a decade ago:

If we then assume public and private lending are not as separated as one may think then one can assume the risk is tied together. It would also appear both forms of lending are now trying to chase to the bottom which will increase competition and as competition increases this can likely lead to private credit creating looser covenants and other perks to make the loans work and win the business.

In an article Bloomberg released on November 5th, 2024 Echo Wong, Venus Feng, and Bei Hu wrote:

“some banks are making conscious decisions to collaborate with private credit players to earn fees and tap ever-deeper pools of capital, while others say the combinations are risky and could infect the banking sector.”

Private Credit Growing Presence In Insurance & Pension Funds:

The risks don’t just stop with the lenders though as private credit has been absorbed by numerous sources in an effort to catch yield and diversify. Moody’s research, reported by the WSJ on November 12th, 2025, shows that illiquid investments made up ~18% or $685B of the $3.8T insurers had at the end of 2024. Alexandre Rajbhandari wrote on November 20th, 2025 about the risks rising in the insurance world. They highlight Connecticut life insurer PHL Variable Insurance Co. which was given a rehabilitation order with the reason for the order according to AFS Law:

“the request for rehabilitation is the result of (1) high face value universal life insurance policies issued by PHL to insureds over 70 years old between 2004 and 2007 maturing, and (2) a substantial portion of the companies’ investment assets consisting of bonds and structured securities that are “below investment grade or are at the very lowest rung of investment grade.” The companies’ General Account, which is used to pay for, among other things, losses claimed under such universal life policies, currently holds approximately $1.4 billion in admitted assets, as reported in the companies’ 2022 Financial Statement. Since the fourth quarter of 2022, claims have typically exceeded $100 million per quarter, including several multi-million-dollar claims under large policies. According to one actuary’s affidavit, “[t]he pace of these claims is expected to continue and likely increase materially since policyholders covered by these [multi-million dollar] policies are mostly in their late eighties and early nineties.” Further, “the projections as of the fourth quarter 2023 show that if claims were to continue to be paid in full in the ordinary course, the Companies’ aggregate assets would be exhausted in 2030, leaving approximately $1.46 billion of policyholder liabilities with no source of payment.”

The companies were placed under supervision by the Commissioner in March 2023.”.

The Bloomberg piece by Alexandre Rajbhandari noted “but there’s growing concern that those high returns benefit from managers’ optimism about the value of their holdings, a luxury unavailable to their peers trading public instruments. There can be wide variation in how managers “mark” identical private assets, with some holding values steady while others report deep losses.”. And as you will read further below, this can be seen with organizations like Renovo and Medallia where these marks changed very fast.

Research from Paul Weiss group has the followng for estimated share of private credit held by insurers broken out by firm:

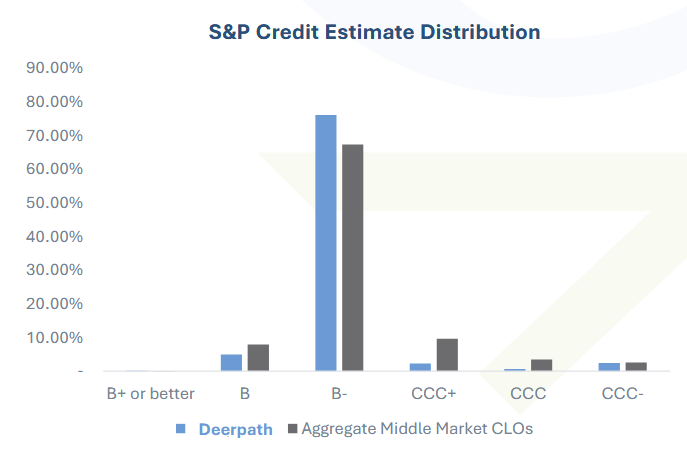

On September 12th, 2024 the West Palm Beach Firefighters’ Pension Fund had a presentation from Deerpath Capital where they noted that banks were “aggressively coming back into the CMM/UMM which has heightened competition and pushed pricing down” and Deerpath also estimated that 81% of the CLO’s they had have a credit rating of B- or better.

Deerpath provided a breakdown of the middle market landscape and broke it into three categories: lower MM, core MM, and upper MM. The lower MM saw companies with enterprise value (EV) of $50-250M and a typical Debt/EBITDA ratio of 3.5-5x, core MM with EV of $250-500M and Debt/EBITDA of 5-6x, and upper MM of $500M+ EV and Debt/EBITDA of 5.5-6.5x. Deerpath also notes EBITDA adjustments are more “aggressive” in the core and upper MM than they are in the lower MM which they label as “moderate”. Deerpath sold their fund to West Palm Beach Firefighters’ Pension Fund with the notion that their Debt/EBITDA by sector was lower than the median based on estimated by S&P Global for Middle Market CLO issuers. The risk of course is a recession where earnings begin to decline and that Debt/EBITDA changes very quickly. Deerpath notes that with a base rate on their loans at 5.5% and all-in coupon of 11.6% their typical borrower could see a 34% decline in EBITDA and still have “sufficient OCF to cover interest expense”. Of course they state that over the past six recessions U.S. business earnings have declined by an average of only 25% at the trough - so nothing to be worried about especially as middle market companies tend to be hit harder.

The risk I see here is many of these valuations are built on EBITDA. While I appreciate EBITDA as a tool I am also aware it can easily be manipulated. The most important factor for these businesses is their real cash flow generation and that is potentially clouded by the heavy reliance on EBITDA. As Deerpath notes the core and upper middle markets are already categorized as “aggressive” in their EBITDA adjustments which means there is considerable risk that debt was provided to organizations that were never worth what lenders assumed.

Debt/EBITDA, interest coverage ratios, and whatever else can change real fast when you stop adjusting that EBITDA figure. What may have been a safe investment for private lenders can turn risky very fast once adjustments come down.

Private Credit and Data Centers:

Private credit has also moved heavy into the data center race. With the narrative AI is going to change our labor force there are risks forming here too. I think some of the content covered in this Substack by Michael Burry also highlights some of the accounting games being played to extend the narrative runway by the hyperscalers.

In the meantime you have Pacific Investment Management Co (PIMCO) and Blue Owl Inc providing $29B in financing for a data center to Meta Platforms. This investment also created a joint-venture between Meta and Blue Owl where “funds managed by Blue Owl Capital will own an 80% interest in the joint venture, while Meta will retain the remaining 20% ownership. The parties have committed to fund their respective pro rata share of the approximately $27 billion in total development costs for the buildings and long-lived power, cooling, and connectivity infrastructure at the campus.”. We also have a special purpose vehicle between Coreweave and OpenAI that is designed to incur its own debt and given the lack of cash flows from either company, private credit is likely to be a participant here.

French Insurer AXA SA said it is now exercising greater caution on the AI build-outs when backing financing via private credit. Jean-Baptiste Tricot, AXA CIO, stated “we are convinced of the medium-term trend, but we want to avoid financing technological gambles” as AI infrastructure has seen “astronomical volumes allocated in recent months”. Tricot states that after First Brands and Tricolor, AXA is doing an accelerated review of their portfolio.

WSJ also ran a story in that to fund data centers the debt is rising fast and insurers have been willing to absorb it and this has likely been a reason credit markets are not showing the stress they likely would as the article states “demand from insurers has broadly been a driving force in the credit markets. It is one factor helping drive spreads on investment-grade corporate bonds—or the premium they pay above the yield on benchmark Treasurys—to around their tightest levels since the 1990s.”. Again, the private and public funding are not as separated as one may think. As Anton Dombrovskiy, a fixed income specialist with T. Rowe Price, stated on data center builds “public and private credit seems to have become a major source of funding for AI investments, and its rapid growth raised some concerns”.

A potential catalyst here is growth CAPEX for data centers is perceived as temporary and as the revenue growth possibly does not materialize then this growth CAPEX will become maintenance CAPEX and from here we will see useful life and/or salvage values adjust down which will bring forth impairment charges. This itself will likely then change the way data center spending is done creating a risk to the private lending.

The rapid change in GPU’s and even with Google coming into the market with their TPU’s it paints a picture that the current investments are likely to be outdated quickly. Perhaps future data centers do not need the power that centers today need or the excessive water for cooling or even the physical space they take up.

As of this writing there are talks that ratings agencies may downgrade Oracle into junk. I share this as if the biggest players are moving into junk status this poses risk for private credit lenders as well. Again, traditional lending and private lending are not as separated as one would expect. If we look at the current depreciation changes by the hyperscalers, rapidly evolving technology, and other factors this could negatively impact current data center valuations which will put many of these loans under water.

Growing Risks In Private Credit:

TCW Group’s CEO Katie Koch spoke in Hong Kong on October 29th, 2025 and stated she was “very nervous” about parts of private credit and CIO of Davidson Kempner Capital Management, Tony Yoseloff, stated there has been a “race to the bottom” in regards to covenants. This supports my view that as banks begin trying to get into the private lending arena the increased competition is increasing the risk lenders are willing to take to get the deal.

Two months ago on October 8th, 2025 Katie Koch did an interview with David Rubinstein where she stated she did not see a bubble in private credit because there is not an imbalance of demand and supply but that demand is rising but because the banks can’t supply as they use to private credit will be here to step in. She also states “I do think that there is the potential of some dislocation in that market, and I think that there could be some accidents because we’ve put so much money out so quickly and we are seeing a deterioration in underwriting standards. So more PIK interest, higher leverage in the part of the portfolios. We’re seeing more extensions. And so there’s probably going to be some incidents.”. Not a bubble though.

Mike Kelly from Barrons would agree as he wrote “the doomsayers see rapid growth and cry “bubble.” They are wrong. Private credit isn’t a bubble—it is a response to regulatory change, market concentration, and the real capital needs of private enterprise.”.

Okay, okay. Maybe First Brands and Tricolor are anomalies and we shouldn’t go looking for Zebra’s just because we hear hoofbeats. Then again we can look at BlackRock who in 2025 acquired private credit firm HPS Investment Partners for $12B and later found out that HPS has lent $500M to a company called Broadband Telecom and the $500M loan was backed by collateral that did not exist. The collateral were emails with invoices that were fake. The lack of due diligence is reminiscent of the GFC and mortgages.

BlackRock also had owned private debt for a company called Renovo Home Partners and in September/October 2025 had the loan valued at 100 cents on the dollar but by the week of November 3rd, 2025 the loan was valued at:

This came as Renovo filed for bankruptcy abruptly. This shouldn’t have been a surprise though as in April 2025 lenders had agreed to swap some of their loan into equity as a means to give Renovo more time. Still BlackRock marked the loan at 100 cents on the dollar until bankruptcy.

On November 19th, 2025 Bloomberg ran a story that BlackRock had a private credit CLO perform poorly and because of this management fees had been waived which is “a rarity in the credit world”. For anyone interested below are a list of a few CLO’s one may want to watch:

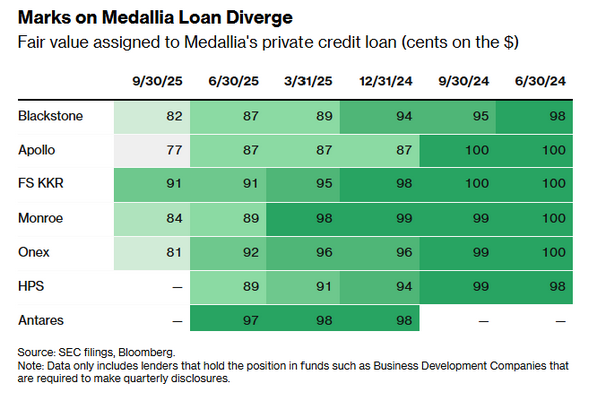

We saw another story that was very similar with Medallia Inc. In June 2024 Blackstone, Apollo, KKR, Monroe, Onex, HPS valued the loan for Medallia at 98-100 cents on the dollar. By September 2025 KKR had the loan valued at 91 cents and Apollo at 77 cents:

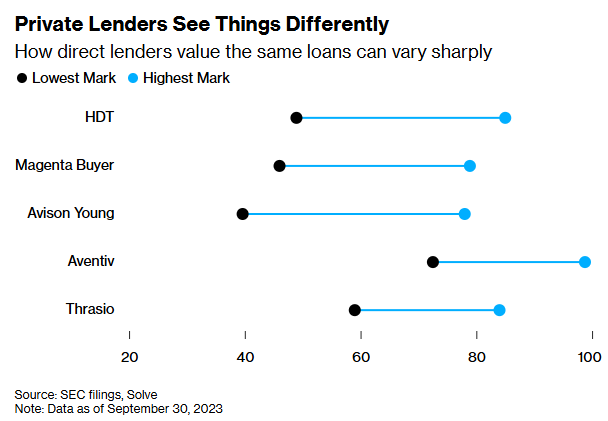

We can see another example of the differing marks on a single loan from numerous direct lenders:

From a February 2024 report it was stated that “In one loan to Magenta Buyer, the issuing vehicle of a cybersecurity company, the highest mark from a private lender at the end of September was 79 cents, showing how much it would expect to recoup for each dollar lent. The lowest mark was 46 cents, deep in distressed territory. HDT, an aerospace supplier, was valued on the same date between 85 cents and 49 cents.”. So we have one loan on the same date value at $0.85 and also $0.49! You see this once and it’s nothing but when you see this multiple times over a few years this is a concern. Marks are marks though and only crystalized once you exit, but hey, the bigger mark is the one believing they will get 100 cents on the dollar here. When you see this level of variance it’s a good signal the truth is much worse than these folks are willing to admit.

Some of the data shows that private lenders mark their positions higher than public pricing:

This topic is something that really should be a major red flag given the size of the private credit market.

This discrepancy to value the loan is yet another indicator that problems we saw in First Brands, Tricolor, Renovo, and others are not isolated. The lack of transparency and reporting that was sold as a feature of private credit have the ability to turn into a bug real quick. Similar to what we saw with marks during the 2007-2008 GFC, these organizations will hold out as long as possible to not have to admit defeat.

Make no mistake though that creativity to kick the can is ever so present here too. The debt-for-equity swap is one method to buy some time, but another is the growing use of PIK or payment-in-kind. The concept here is the borrower cannot pay the interest on the debt so the lender allows them to forgo the cash payment and tack on interest as more debt to the end. I mean, if you can’t pay your interest now I am sure you can pay back the original principal plus! PitchBook notes that about 30% of the private credit loans with a PIK component are coming due in the next two years.

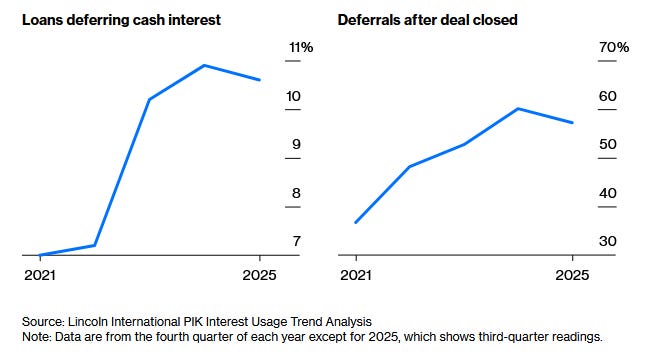

If PIK wasn’t enough let me introduce you to the synthetic PIK. The synthetic PIK allows a borrower to pay cash interest instead of the non-cash “in kind” payment where they tack it onto the principal at the end by allowing the borrower to create a SIPF or synthetic interest payment facility for the purpose of the borrower to draw down the funds to pay cash on the primary loan. The SIPF is often pari passu with the primary debt but it gives the illusion that all is well. Lincoln International views the use of PIK as a sign of distress and has called this a “shadow default rate” as the reality is if the company cannot pay the cash interest then they would have already been in default.

Even with these can kicking scenarios the default rate of 1,200 private borrowers ticked up to 5.2% on a trailing 12-month basis according to Fitch Ratings. Without the debt-for-equity swaps and tools like PIK or synthetic PIK default rates would be much higher. Lincoln International shows that in more than 10% of private credit deals borrowers are paying their interest with more debt. It is estimated that 1 on 10 private credit firms are deferring cash interest payments in 2025 and at least 45 have already been taken over by their lender - most in six years.

If we go back to the EBITDA adjustments I touched on with insurance & pension funds, if one considers EBITDA adjustments are more pervasive than they appear the risk is far greater too. In February 2025 Sridhar Natarajan, Libby Cherry, and Marton Eder wrote about Schur Flexibles who was trying to be sold by the firm Lindsay Goldberg and was backed by numerous investment firms to help get the deal done only to find out the EBITDA that was sold was not real. In 2020 Schur Flexibles restated their earnings and EBITDA was slashed by two-thirds and KPMG recommended even bigger cuts for the prior two years!

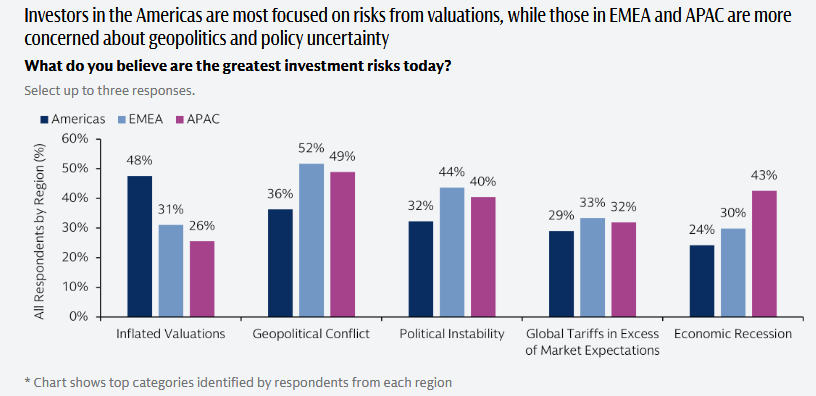

A 2025 survey by Goldman Sachs shows that for the Americas inflated valuations are one of the greater risks today:

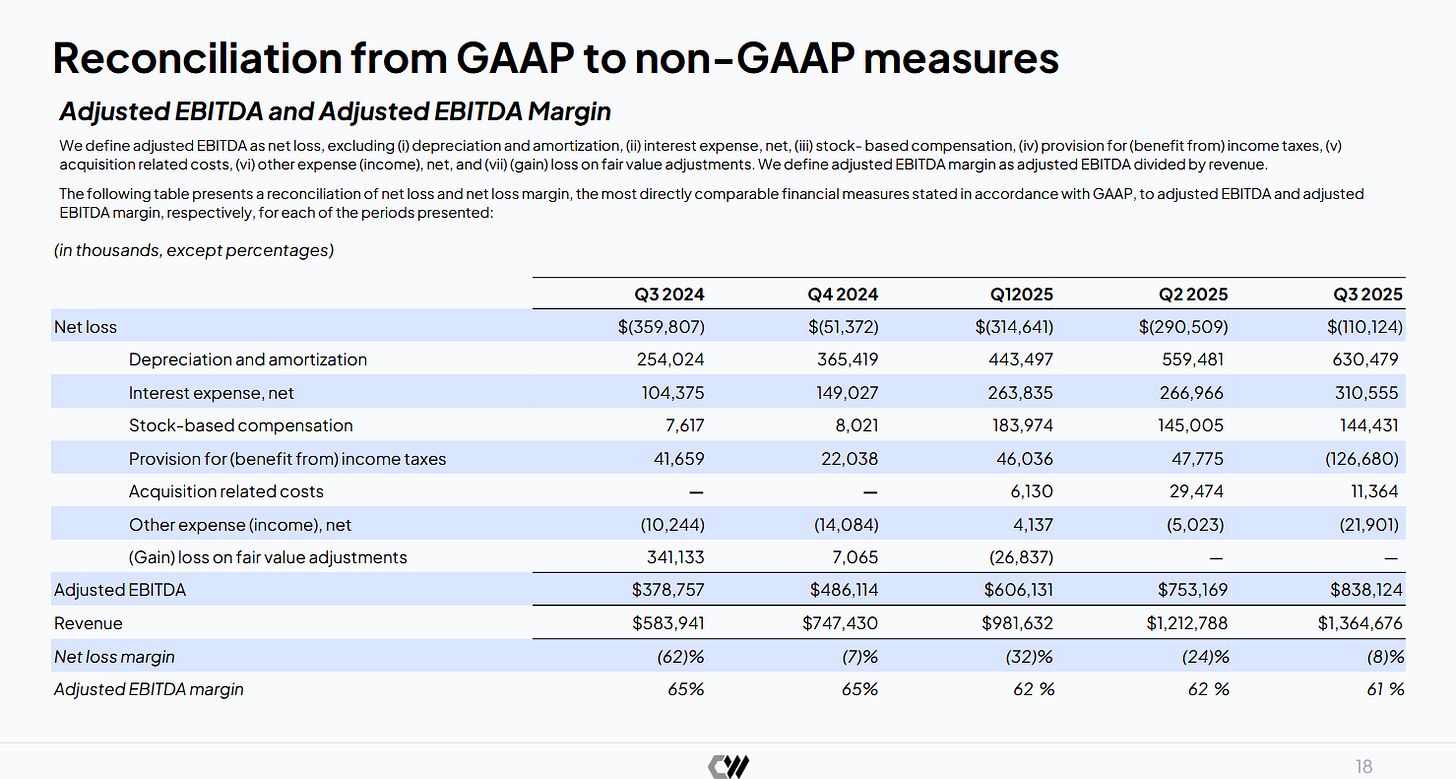

As we see with so many EBITDA adjustments in big firms today where SBC and other things are added back it’s not hard to see that this key measure of earnings potential in private credit can be easily inflated. For example, below is a snip from Coreweaves earnings where they present to shareholders an adjusted EBITDA in which they add-back acquisition costs, SBC, and other expenses to give an adjusted EBITDA that shows a 61% margin:

It is not then hard to speculate what is being done in these middle market organizations if the publicly traded darlings are doing this; especially as the insight from Deerpath already shows EBITDA adjustments are “aggressive” in the core and upper middle market organizations. Even if the private debt is senior secured it doesn’t mean much if the value of the enterprise can’t cover it or cash flows stop growing. I also think the growth of LME’s will only become a bigger problem in the private credit space. With traditional lending the growth of LME’s has been a major topic and I would suspect future lending will offer much tighter covenants to prevent the current tools being used on them, but in private credit this is still a risk to lenders. Asset values, inflated valuations, and various other factors make any protections less secure even if the debt is secured.

Paul Weiss group also shared this breakdown on private credit and LME’s and highlights that many of the protections that do exist are far weaker than lenders may be ready for:

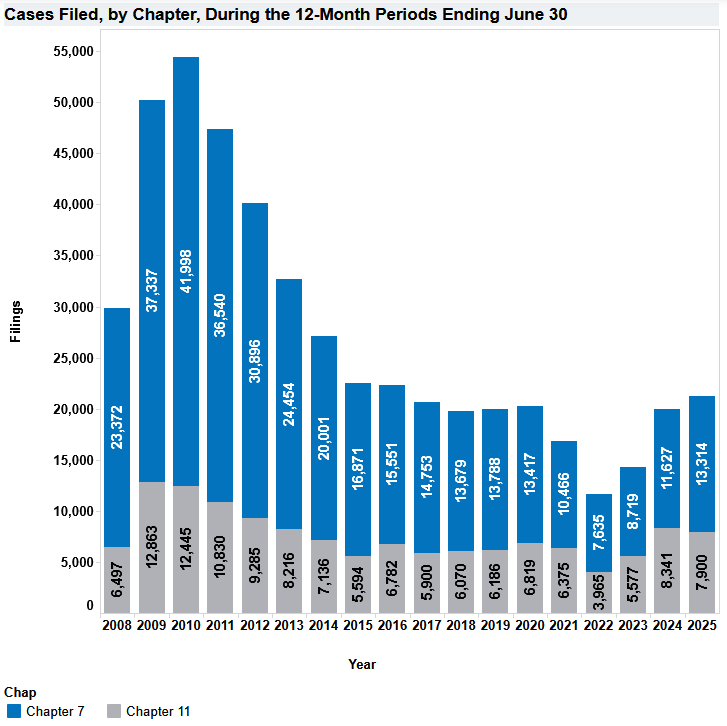

LME’s have become the new tool in town, but their major purpose is simply to buy time - that’s it. An LME is not meant to solve what bankruptcy is meant for so while it is likely we will see a rise in LME we must also consider we are starting to see growth on both Chapter 11 and 7 filings in 2024 & 2025:

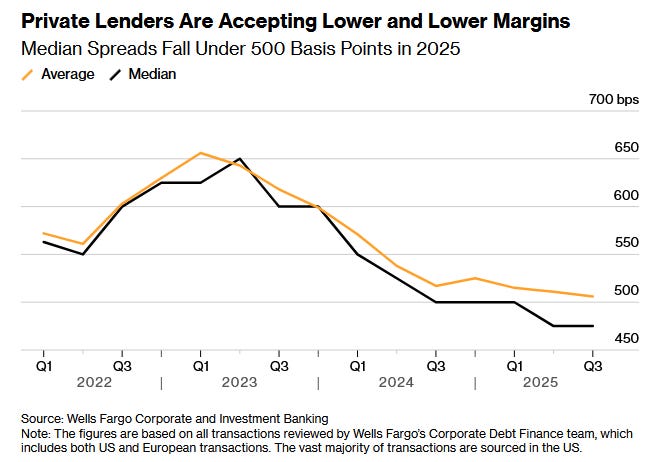

As competition in the private credit space heats up too lenders are taking on lower and lower margins as noted by Wells Fargo; median spreads fall under 500 bps in 2025. Given many of these rates are floating, as is the case with Deerpath, even as monetary policy loosens this can make these loans unprofitable even outside of changes to the underlying assets valuations.

Conclusion and Final Thoughts:

I started this write-up more as a way to frame my own thoughts on this complicated subject. What a takeaway should be is that the market is rapidly growing and perhaps growing too fast. During these rapid expansion periods caution is often thrown to the wind especially as incentives are in place that reward such behavior. If we look at Broadband Telecom as a canary perhaps we can see how loose some due diligence has been on valuing these companies. If a $12B organization like HPS can be fooled by Broadband Telecom or even if large creditors can be fooled by First Brands or Tricolor then it’s easy to see that these issues can go much deeper than anyone expects.

The lack of transparency, reporting, and overall honesty in the private credit space is one that has allowed it to flourish the past decade and accelerate post 2022. Because of this though getting a feel for how deep these problems go is rather difficult. First Brands itself is a catastrophic collapse where almost all debt is now valued around $0.01 while DIP loans are at $0.65 and while everyone is focused on this in isolation perhaps we need to be asking where were regulators? Where were the guardrails? Who are the adults in the room? Why of course they were not here because if they were this growth would likely have not occurred as it has. That has been the “perk” of private credit.

If we take the work that Michael Burry shared on the hyperscalers and understand that even the biggest players on the public stage are doing thing to make earnings look better, then what do we think the smaller players are doing? If the rise in “shadow defaults” AKA PIK use is any indicator, then we can already get a sense that cash flows are not as strong in the private credit space as valuations would make them appear. What would default rates really look like without the use of such tools?

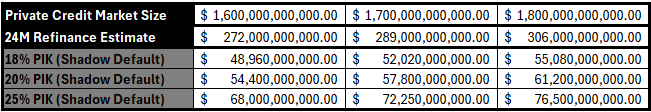

With $3.2T of corporate debt set to mature in the next two years this will likely create a feeding frenzy as private credit and now traditional lending race to the bottom. As PitchBook shared, BofA estimates that 17% of all private credit loans will also mature in the next two years which is roughly $272-$306B if we go with the $1.6-1.8T size of the private credit markets. There are some major refinancing risks here if we consider what we are already starting to see. If we take the PIK as a shadow default as Lincoln would state, then below is the possible estimated exposure over the next 12-24 months:

If the PIK is indeed a real view into shadow defaults these can start to ramp up fast. Economic recovery is of course what’s really what matters, but if First Brands and a few others are of any worthy proxy one can at least be aware that a default does not guarantee assets allow lenders to claw anything back. Especially if we consider the rise in business Chapter 7 filings with this too. When stress does really present itself here it will likely result in real economic loss as well a slowdown in lending at a minimum which itself will create a bottleneck in economic growth. There are enough signs to look at and see the markers of trouble at minimum though.

My favorite band is Guns N’ Roses and as I wrap up my thoughts I think of this lyric from my favorite song of theirs titled “Coma”:

“There were always ample warnings, there was always subtle signs. And you would have seen it comin’ but we gave you too much time”.

-Sean

P.S. In 2021 KKR acquired majority of Global Atlantic and then the remaining in 2024 which gave them access to the insurance business and also in 2021 Apollo bought Athene for $11B for the same. Makes one wonder if insurance companies are buying so much private credit, as I wrote above, and the issuers also are also potential buyers……

KKR has been very, very vocal on how safe private credit it.

Another one highlighting the risks here. Peraton private credit loan is now being sold as primary lenders try and exit. Marks of course on loan value range all over.

“FS KKR marked the second-lien position at 89 cents as of Sept. 30, while the T. Rowe Price OHA Select Private Credit Fund marked the position at 61 cents in the same period. Blackstone marked its second-lien position at 60 cents on the dollar as of Sept. 30, and Blue Owl Capital Corp. marked its second-lien position at 59 cents.”

This is the second such instance of KKR marking a loan higher than others.

It highlights the fact one cannot trust what's happening here.

https://pitchbook.com/news/articles/peraton-private-credit-loans-trade-as-multiple-banks-make-market-for-debt